utah state tax commission tap

For 2021 tax year returns only. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

Go to taputahgov Under Send us click Attach Submit ID Verification Documents Enter the Letter ID provided in the header of the letter you received from the Tax Commission requesting.

. In accordance with Utah Code Annotated 59-2-202 each centrally assessed Utility and Transportation taxpayer must annually file on or before March 1 a completed Annual Report. Utah Tax Commission information registration support. You are being redirected to the TAP home page.

Businesses and representatives accountants bookkeepers payroll professionals etc can use TAP to manage their Utah business tax accounts. On the Login window click Forgot my Password. Official income tax website for the State of Utah with information about filing and.

Motor Vehicle Enforcement MVED. If you are not redirected to the TAP home. Ad New State Sales Tax Registration.

Who can use TAP. Automate manual processes and eliminate human error with Sovos tax wihholding solutions. Ad Accurate withholding repotting to federal state and local agencies for all transactions.

All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Enter your username in the Username field. Utah Taxpayer Access Point TAP Tax Commission Session Timeout Your session has expired.

Utah State Tax Commission Tap Options for Liens Levies and Wage Tax levy Offers in Compromise Penalty Abatement Discussions Harmless Partner Alleviation Statements Tax. The Tax Commission cannot issue a refund prior to March 1 unless we have received both your return and your employers required return. Ad Download or Email UT TC-69C More Fillable Forms Register and Subscribe Now.

Frequently asked questions about Taxpayer Access Point. Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0260 ADA Accommodations If you need an accommodation under the Americans with Disabilities Act. Enter the answer to your secret question and click Submit.

This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns. Address Phone Numbers 210 North 1950 West Salt Lake City Utah 84134 Phone. Official tax information for the State of Utah.

801-297-2200 or Toll Free. Taxpayer Access Point TAP. Interest on any underpayment.

Due to our efforts to protect your identity please. What Do I Do.

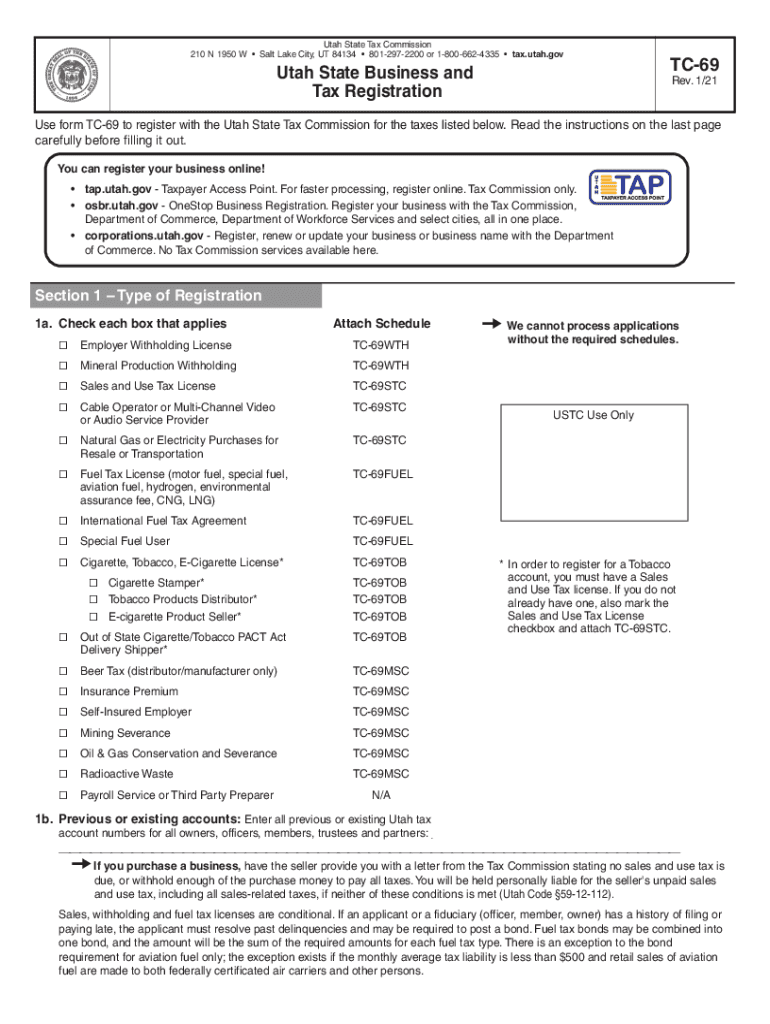

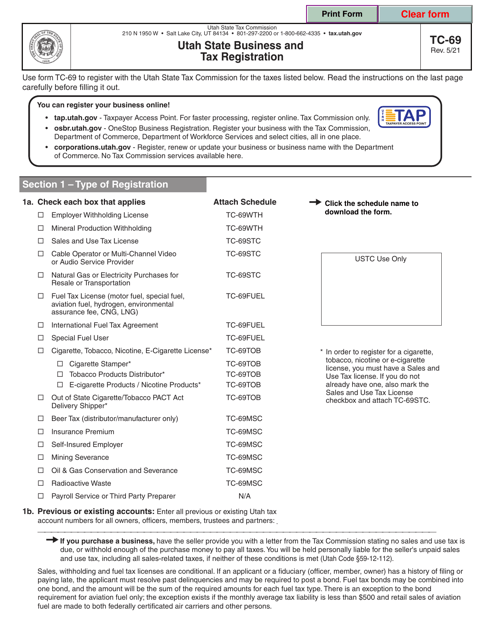

Ut Tc 69 2021 2022 Fill Out Tax Template Online Us Legal Forms

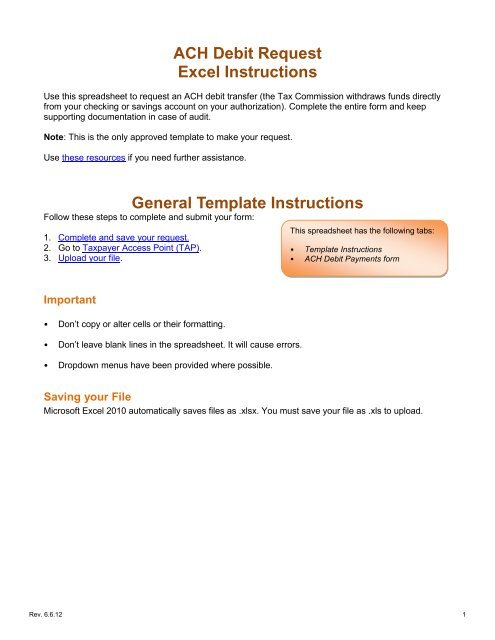

Ach Debit Request Excel Instructions Utah State Tax Commission

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Utah State Tax Commission Official Website

Utah State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

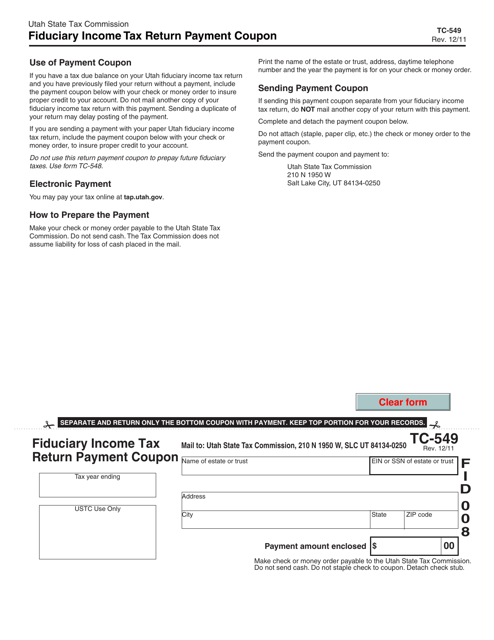

Form Tc 549 Download Fillable Pdf Or Fill Online Fiduciary Income Tax Return Payment Coupon Utah Templateroller

Utah State Tax Information Support

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong

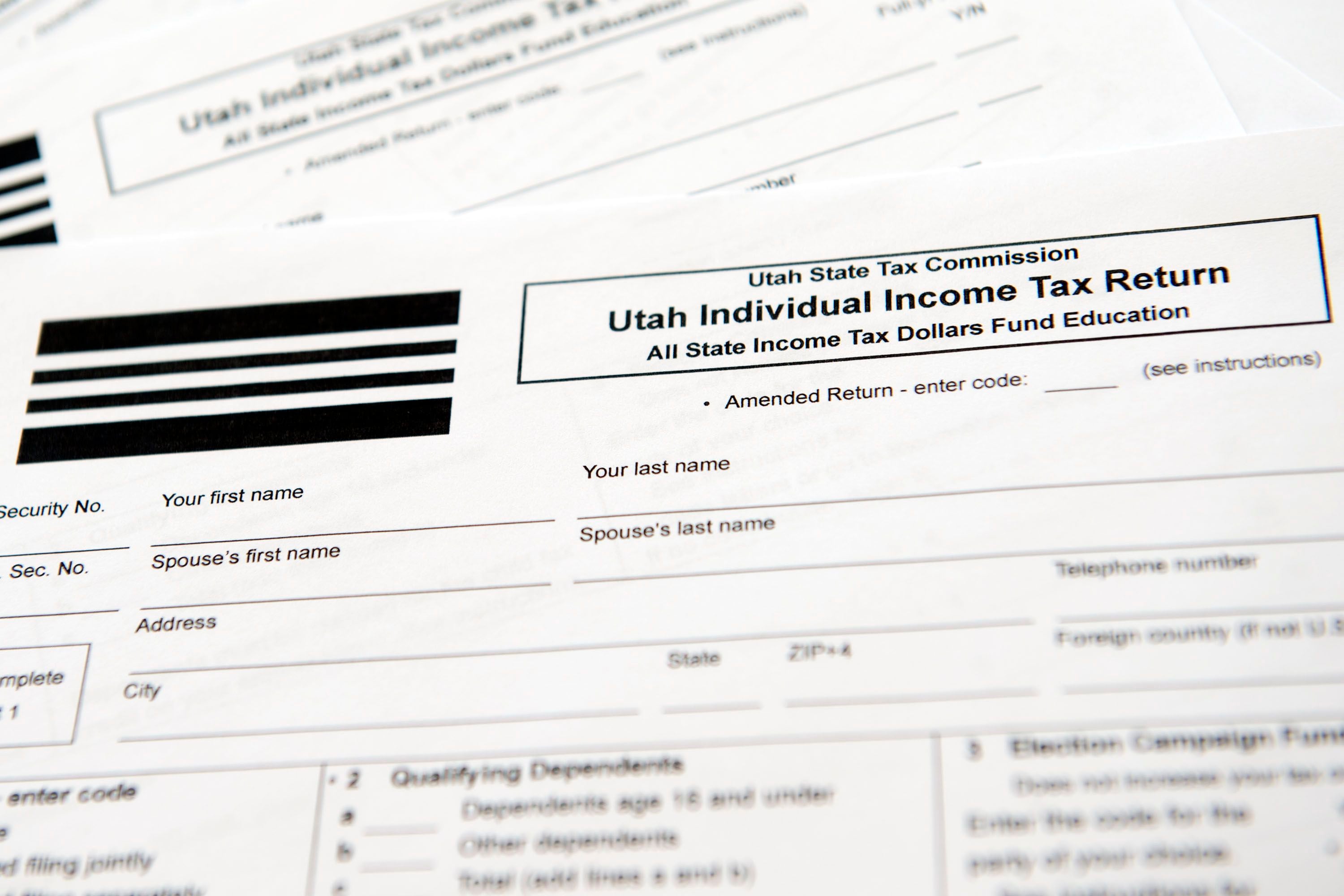

Utah State Income Tax Return Information Prepare And Efile Now

![]()

Utah Income Taxes Utah State Tax Commission

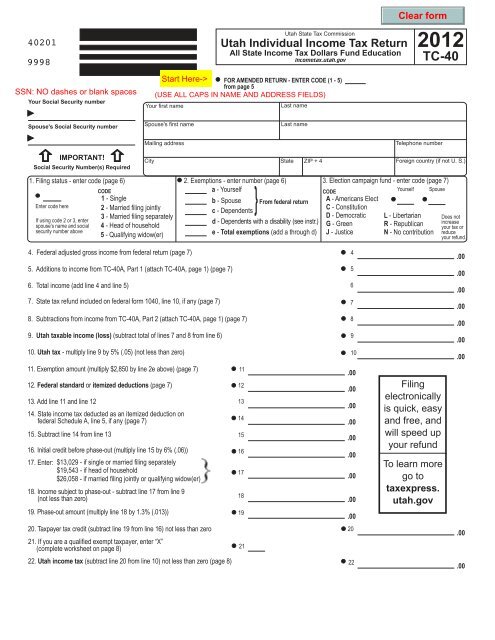

Form Tc 40 Utah State Tax Commission Utah Gov

Still Waiting For Your State Income Tax Refund Something Is Probably Wrong